How to Close Your ICICI Bank Account Online in 2024

In an age where digital solutions reign supreme, managing banking activities online, including closing accounts, has become increasingly straightforward. This article provides a comprehensive guide on how to close your ICICI bank account online in the year 2024. Whether you’re looking to streamline your finances by reducing the number of bank accounts you have or switching banking services, closing your ICICI bank account online can be a smooth and efficient process when done correctly.

Understanding the Process to Close ICICI Bank Account Online

To close your bank account at ICICI Bank, you’ll need to follow a specific process. First, ensure all remaining funds are withdrawn and any auto-debits are cancelled. Visit the official website to download the account closure form from the ICICI. Gather your passbook, chequebook, and any unused leaves, along with proof of address and a self-attested copy of your address proof. It’s crucial to clear any minimum balance dues since closure charges might apply.

Next, visit the nearest ICICI or the ICICI bank branch where you opened the account. Submit the completed paperwork to the bank, ensuring you’ve filled out every required detail to avoid delays. Account closure charges may vary, so inquire about any fees to ensure you’re not caught off guard. Lastly, after submitting the form, your account will be closed within 30 days, and you should receive a confirmation on your registered mobile number.

What is the Online Closure Process for an ICICI Bank Account?

The process to close an ICICI Bank account involves several steps aimed at ensuring the customer’s decision is well-informed and all financial obligations are fulfilled. The online closure method allows customers to initiate the procedure from the comfort of their home. The account closure process primarily involves submitting a duly filled account closure form along with the necessary documentation to facilitate the request. With advancements in banking technologies, ICICI has made it possible to access these forms and submit them online, making “how to close ICICI Bank account” a hassle-free query to resolve.

Can I Close My ICICI Bank Account Without Visiting the Branch in 2024?

Yes, you can close your ICICI Bank account online without the need to visit a branch in 2024. This advancement benefits customers who lack the time or means to visit the bank in person. Through the official ICICI Bank website, individuals seeking to close their accounts can download the necessary paperwork, complete the account closure form from the comfort of their home, and submit it through the online portal provided by the bank. This process exemplifies ICICI Bank’s commitment to providing convenient and accessible banking services.

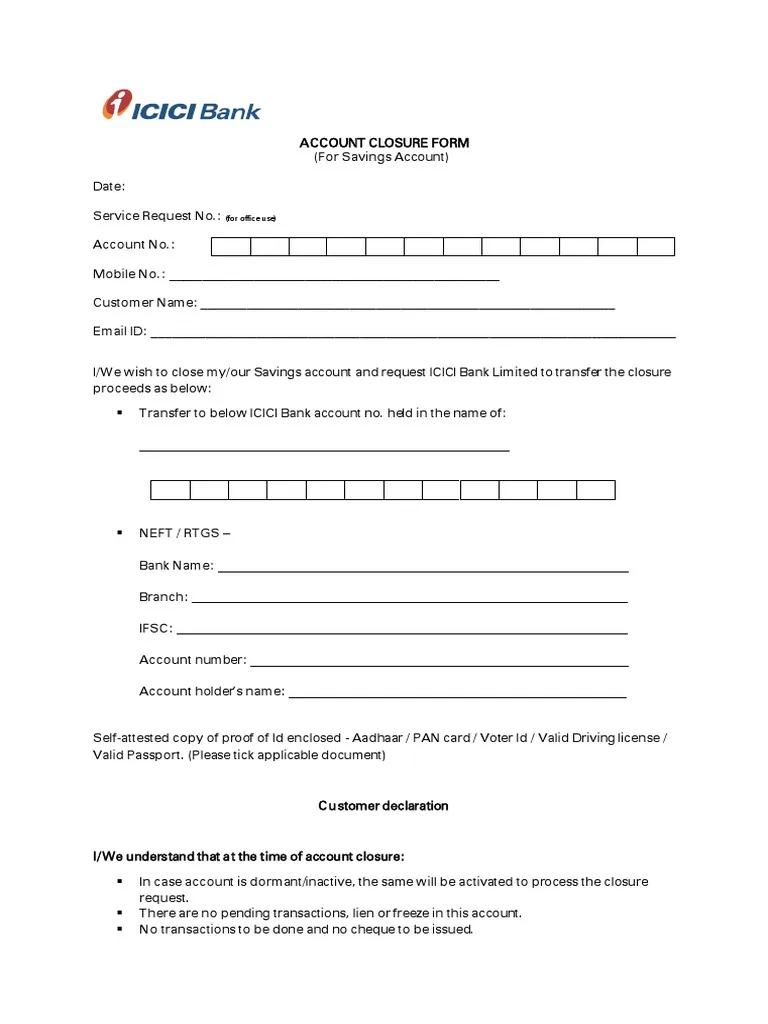

Is There an Account Closure Form Available Online?

Indeed, the account closure form required to close your ICICI Bank account is available online. This form PDF can be easily downloaded from the official ICICI Bank website. Offering the closure form online is a testament to ICICI Bank’s understanding of customer needs for a simple and efficient online method to manage their accounts, including the finality of closing one.

Also Read: How to Cancel Order in Zomato?

Step-by-Step Guide to Fill Out the ICICI Bank Account Closure Form PDF

To fill out the ICICI Bank Account Closure Form PDF, first download the form from the official ICICI Bank website. Ensure you have the latest version to avoid any discrepancies. Begin by entering your account details, such as account number and account holder name, clearly and accurately.

Next, specify the reason for closing your ICICI Bank account. Choose from the options provided or write a brief explanation if selecting ‘Other’. Don’t forget to include your contact information for any follow-up required. Review the form for completeness and accuracy before submission.

Where to Find the ICICI Bank Account Closure Form in PDF Format

Locating the account closure form PDF is the first step in starting the procedure to close your ICICI Bank account. This document is easily accessible through the official ICICI Bank website. Upon visiting the site, navigate to the forms or document center section, where various customer service forms are available for download. Here, you’ll find the account closure form among other necessary forms, ready to be downloaded and filled out.

How to Properly Fill the Account Closure Form Online

Correctly filling out the account closure form is crucial for a seamless process. Ensure all required fields are completed, including personal information, account details, and reasons for account closure. If you hold any additional products with ICICI, like account linked mutual funds or an ICICI credit card, specify your arrangements for these within the form. It’s imperative to double-check the information provided for accuracy to avoid any delays in processing your request.

Submitting the Completed Account Closure Form PDF Online

After filling the account closure form, the next step involves submitting it for processing. This can typically be done through an email address or upload feature provided on the ICICI Bank website. Alongside the form, ensure you attach any required documentation, such as identity verification papers, to substantiate your closure request. It’s advisable to keep a copy of the form and any correspondence for your records until the closure is confirmed.

Understanding ICICI Bank Account Closing Charges

Understanding the account closing charges of ICICI Bank is crucial for customers wishing to close their accounts. These charges can vary depending on how long the account has been active. Typically, ICICI Bank may waive the closing charges if the account is closed within a specific period after opening, but charges may apply if closed thereafter. It’s important to review the latest fee structure on the ICICI Bank website or consult with customer service for the most accurate information.

What Are the Charges for Closing an ICICI Bank Account in 2024?

Closing an ICICI Bank account might incur certain charges depending on the type of account and the duration it has been active. Usually, if the account is closed within a specific period after opening, charges may apply. By 2024, these charges can vary, so it’s recommended to review the most current fee structure on the official ICICI Bank website or contact customer service for detailed information.

Are There Any Hidden Charges When Closing Your Account?

ICICI Bank maintains transparency in its fees and charges, including those related to account closure. However, it’s crucial for customers to inquire and understand all possible charges before proceeding with the closure to avoid any surprises. This might include service fees or penalties for early closure, which should be detailed in the account’s terms and conditions.

How to Avoid Paying High Charges for Account Closure?

To avoid or minimize charges associated with closing your ICICI Bank account, consider waiting until any minimum required period elapses to close the account. Additionally, ensuring all pending transactions, including automatic payments or debits, are cleared can prevent last-minute fees. Checking for any potential refunds or waivers for the closing fees can also help reduce the cost.

Documents Required to Close ICICI Bank Account Online

To close an ICICI Bank account online, customers must provide specific documents. The primary document required is a duly filled Account Closure Form. Additionally, individuals need to submit identity proof, such as a PAN card or Aadhaar card. It’s also essential to ensure that all cheques, debit cards, and credit cards linked to the account are returned or deactivated.

What Documents Do I Need to Close My ICICI Bank Account?

The list of documents required to close an ICICI Bank account includes identification proof, such as a passport or Aadhaar card, and any bank cards or cheque books issued. Exact requirements might vary based on the account type and customer profile. It’s essential to gather all necessary documents before initiating the closure process to ensure a smooth transition.

Can I Submit the Required Documents Online?

Yes, ICICI Bank allows the submission of documents needed for account closure online, aligning with the digital-first approach in banking services. This convenience aims to simplify the process for customers, eliminating the need for physical visits to the branch. It’s crucial, however, to ensure that the digital copies of these documents are clear and legible to avoid any processing delays.

Verifying Your Identity for the Online Closure Process

Identity verification is a critical step in the account closure process to protect customer privacy and prevent fraudulent activities. This procedure typically involves providing a valid form of government-issued ID and possibly answering security questions based on the account history. Digital methods, including one-time passwords (OTP) sent to the registered phone number or email, may be employed to confirm your identity securely online.

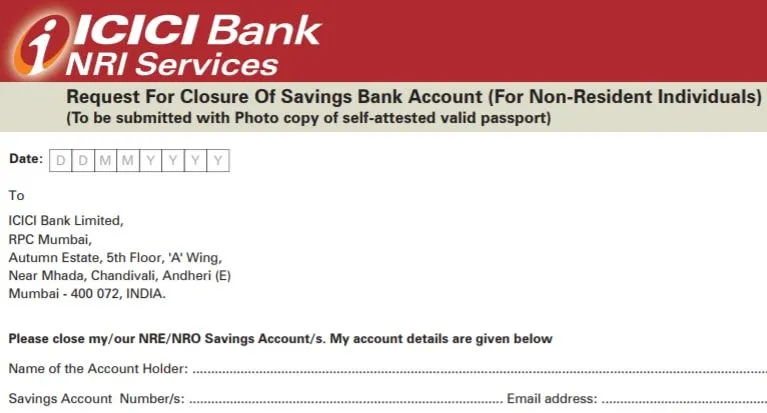

Special Considerations for Closing an ICICI Bank NRI Account Online

When closing an ICICI Bank NRI Account online, consider the specific requirements like providing a valid passport copy and valid visa or OCI/PIO card. Ensure all linked accounts such as fixed deposits are closed or transferred. Additionally, understand the tax implications and clear outstanding dues to avoid complications.

Is the Process Different for Closing an ICICI Bank NRI Account?

The basic process of closing an ICICI Bank NRI (Non-Resident Indian) account online shares similarities with closing a regular account but may involve additional steps or documents, reflecting the nature of international banking. Such requirements are in place to comply with different regulatory environments and to safeguard against financial crimes.

Additional Documents Required for NRI Account Closure

For NRI account holders, additional documents might include proofs of overseas and Indian addresses, a copy of the passport, and any other documentation pertaining to financial assets held in India. This comprehensive documentation is necessary to complete the account closure process while ensuring compliance with regulatory requirements.

How to Ensure Smooth Closure of Your ICICI NRI Account from Abroad

To ensure a smooth and efficient closure of your NRI account from abroad, it’s advisable to start by reviewing the latest guidelines and requirements on the official ICICI Bank website or contacting customer support directly. Utilizing online banking services to settle any outstanding balances, transferring funds to another bank if necessary, and submitting all required documents digitally can streamline the process. Regular follow-up through email or customer service channels can also help in keeping track of the account closure status.